Requiem for Globalization

Starting with the pandemic and then with the sanctions imposed on Russia for its unjustified and brutal attack on Ukraine, the concept of a single global market without regard to borders and distances is becoming more complicated by the day. In many cases, this is bad for business.

Having to wait for components that are perhaps only 1% of the finished product, but if they do not arrive, they cannot be delivered; paying up to 5 times more for the transportation of a container than just a year ago; knowing that the money will not necessarily arrive if for political reasons it can be frozen, makes it necessary to return to a concept of self-sufficiency that allows ensuring the supply, even if it has a robust inflationary impact.

A country like Russia that has 643 billion dollars of reserves, but 80% of them are frozen in the Western financial system, makes us doubt how much these resources are really worth if they are not accessible at any given time.

Today I ask myself, where are the leaders of the world? As far as we look, there is not a single president, prime minister, or king who has the capacity to lead his country, with the possible exception of Xi Jinping in China. But he too has his problems in his transition from exporting to consuming country. His real estate sector is bankrupt or his brutal repression of the Uyghurs.

President Biden’s cognitive ability is deteriorating by the day. On his recent trip to Europe, he made three inane and out-of-place comments that had to be corrected by the White House within minutes after he said them, as they were the opposite of previously stated policy. The current administration’s major recent “accomplishments” are the signing of a law condemning lynching as a racial crime and the validation of transgender people to demonstrate publicly and without any penalty for their sexual orientation.

Governor DeSantis of Florida signed a decree where sex education could not be taught to children before third grade. Progressives attacked it for its “inadequacy” to the reality we live in.

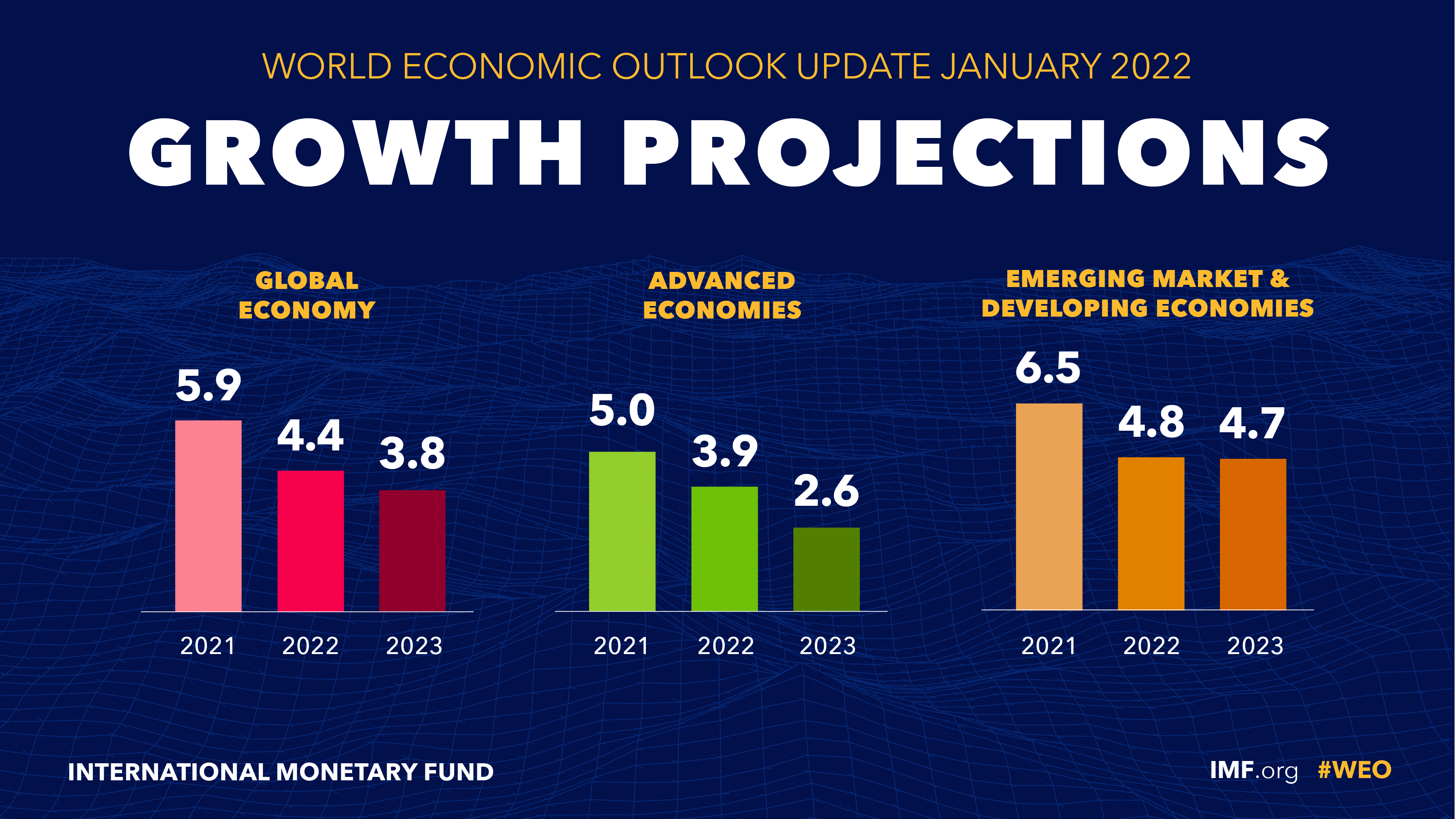

There is no doubt that the economic situation in the United States is very different from that in Europe. Americans continue with GDP growth of over 3%, unemployment at 3.6%, demand for homes at its peak, and consumers spending their money. By contrast, in Europe, there is no shortage of workers; the Russian war has created tremendous inflationary pressure, especially for energy importing countries, and the expectation of growth of barely 1% by 2022 and perhaps 2.4% by 2023.

Sovereign bond yields in Western Europe have already turned negative again despite inflation; unlike the Fed, the European Central Bank does not plan to increase the discount rate for fear of creating a recession.

It is worth noting that Europe imports 25% of its oil and 40% of its natural gas from Russia, which is why they have not been very emphatic about imposing sanctions. Oil accounts for 4.3% of global GDP, and when it rises excessively, it creates a redistribution of wealth between producing and importing countries.

In the United States, average home prices have risen 47% in the last three years thanks to a combination of very cheap mortgages, the lack of new home construction due to a lack of confidence from large developers, and the fact that many people are not returning to work in offices, requiring more space to be able to work from home. We will see if this demand contracts as mortgage rates rise, as fewer people will qualify for credit.

The bills sent by Biden to the Senate are still being held up thanks to Senators Manchin and Sinema, who are Democrats, yet fiscally responsible. I believe the only way the famous human infrastructure bill will pass will be if social programs are cut back and brought in line with the potential revenue stream to avoid a massive increase in the public debt, already at 33 trillion dollars. It is incredible to think that each .01% increase in the cost of the debt represents an increase of $3.3 trillion in spending for the U.S. government and, therefore, a more extensive public debt.

The situation in Mexico continues to be extremely complicated with a new wave of violence with incidents of mass murders such as what happened at the soccer game in Queretaro or what happened in Michoacan. The death of many journalists has brought protests from all over the world. The consequence and not very understandable response of Foreign Minister Ebrard and President Lopez Obrador himself, angry and surprised by the claims of foreigners, since they consider it interference in Mexico’s internal affairs.

I am very concerned to see that, little by little, the current administration in Mexico is trying to change the laws and the control mechanisms that prevent the abuse of power by the executive, legislative and judicial branches.

The attacks on INE, the proposal that the commissioners of the electoral institute be elected by a vote of the people, and the famous and infamous consultation on the revocation of mandate, which by its language requires 37 million votes to be implemented and where it is not believed there will be more than 10 million participants, are representative of a transformation of a country that has always been characterized for being pendular, oscillating between a “wise left” and a “moderate right”, an inclusive country where all citizens found something to identify with and in which there have been 112 years of stability since the revolution of 1910. This transformation leaves many Mexicans who disagree with the current policies out of the system.

I feel that there is no solid opposition to motivate voters; should the trajectory continue, it will favor a Morena candidate following the form of AMLO, -who reminds me of the famous phrase of Pancho Villa who said: “First kill and then verify” with the provisions of preventive imprisonment for presumed tax evasion, sale of “confiscated” real estate before the trial that caused the act of the authority, etc.

I found exciting the case of the first Independent Prosecutor, Gertz Manero, who, being supposedly the defender of the rule of law, tried unsuccessfully to influence a decision of the Supreme Court of Justice. It would be interesting to know who authorized the tapping of the telephone of the highest judicial authority in the country, and it could be that such order came from the National Palace.

Another idea recently floated by the presidency was the elimination of plural-member deputies, which would give more strength to Morena, who obtained a much larger number of votes than the opposition parties.

Analysts have reduced projected growth for Mexico four times, and it is now at 2.1% for 2022, with inflation close to 6%. Without gasoline subsidies, inflation would be at least 1.7% higher, and with the suggestion to export more crude oil and import gasoline, I wonder what the reason for the purchase of the Deer Park refinery was.

Two curious facts that catch my attention: While almost all central banks are starting to fight inflation, China has already cut its discount rate twice, as the 5.5% GDP growth projected for 2022 is insufficient for the number of people it plans to bring into the formal economy. The second is that in countries where inflation has skyrocketed, such as Brazil, the interest rate charged by banks on unpaid credit card balances is 346.3%!!! Per annum.

March was a terrible month for bonds, as interest rates went up almost 0.7%, and when this happens, the price of fixed income instruments goes down.

Stock markets recovered about 40% of the loss of the previous two months. The currencies of strong economies declined against the dollar due to the expectation of higher rates in the United States. The Brazilian real and the Mexican peso were 2 of the currencies with the most significant appreciation in the world.

The peso strengthened for three reasons: first, the 0.5% increase in the Banxico rate; second, the rise in oil prices, where Mexico is an important exporter; and third, the fiscal discipline of AMLO continues without incurring deficit spending, although the country’s economy is at a standstill.

Gold reached its highest point in many years at $2042 but gave back almost all of the gain to sit just above $1,900/oz.